尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

Spreadsheets are staples of business life. But — as with sausages and laws — it is harder to respect them if you know how they are made. Users are overwhelmingly self-taught. The migraine-inducing slog of plugging numbers and formulas to a tight deadline invites shortcuts. Unsurprisingly, errors are rife. Research suggests nine out of 10 spreadsheets contain a mistake.

电子表格是商业生活的必需品。但是,就像香肠和法律一样,如果你知道它们是如何制作的,你就很难尊重它们。绝大多数用户都是自学成才的。在紧迫的截止日期前填入数字和公式,这种让人头疼的苦差事容易让人走捷径。不出所料,错误频发。研究表明,90%的电子表格都存在错误。

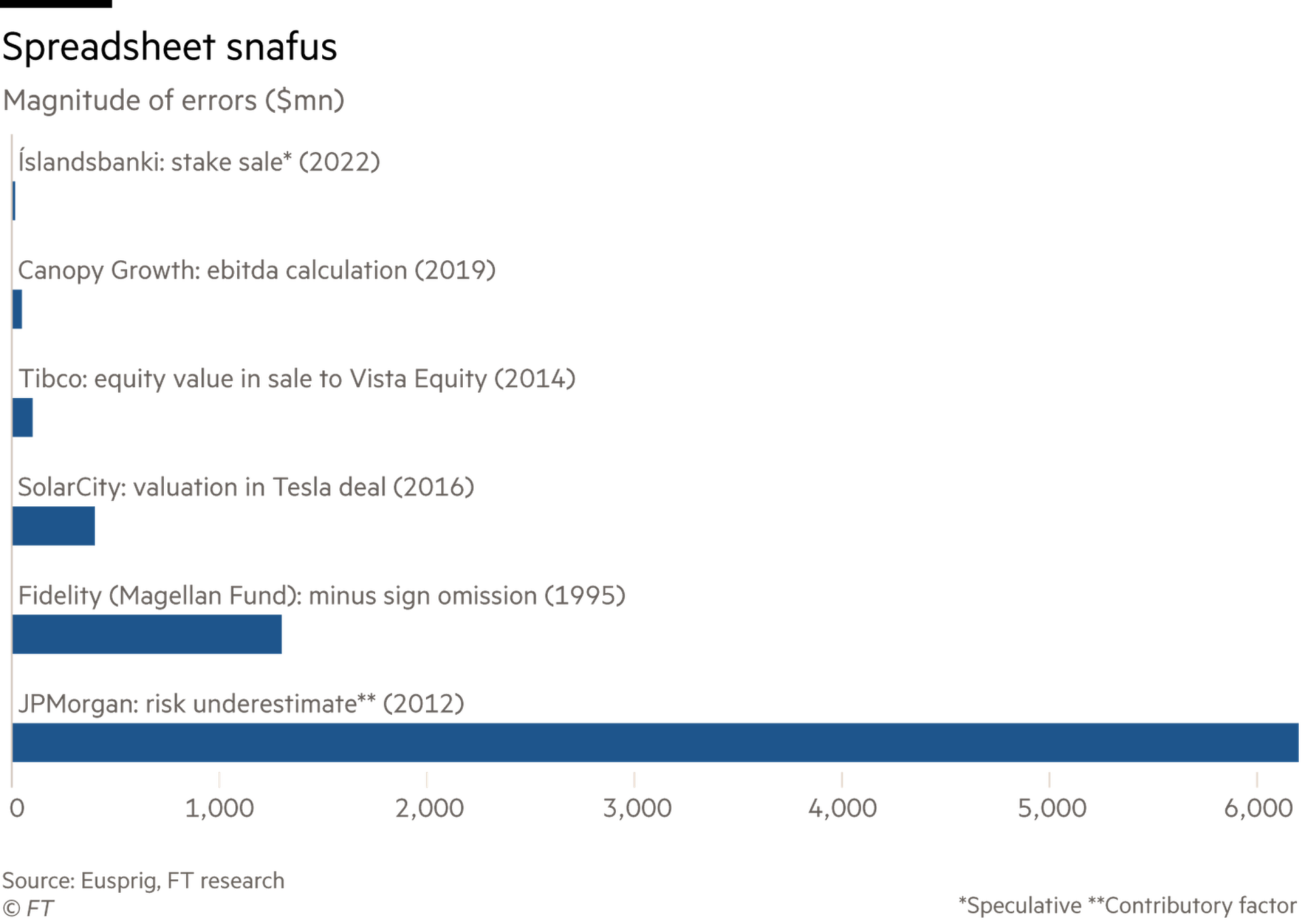

Iceland mispriced its sale of a slug of Islandsbanki shares earlier this year, after an Excel spreadsheet omitted investors’ offers that had included “foreign commas or amounts defined as text”. The impact is disputed but might have cost as much as $16mn.

今年早些时候,冰岛在出售Islandsbanki的部分股票时定价有误,原因是一份Excel电子表格漏掉了包含“定义为文本的外国逗号或金额”投资者报价。其影响是有争议的,但可能花费高达1600万美元。

Such failures of data error cleaning and testing are all too common, according to the European Spreadsheet Risks Interest Group (Eusprig). This group of researchers has been sounding the alarm for 20 years. High on its list of spreadsheet horror stories was JPMorgan Chase’s $6.2bn “London Whale” trading losses in 2012. That featured an error-ridden model that required data to be manually copied and pasted from one spreadsheet.

据欧洲电子表格风险利益组织(Eusprig)称,这种数据错误清理和测试的失败太常见了。这群研究人员20年来一直在敲警钟。摩根大通(JPMorgan Chase) 2012年62亿美元的“伦敦鲸”(London Whale)交易亏损,是该公司电子表格恐怖事件中最吓人的一件。那是一个错误百出的模型,需要从一个电子表格中手动复制和粘贴数据。

A spectacular blunder in an influential Harvard University paper on public debt and growth cast doubt on a cornerstone of the austerity policies introduced after the financial crisis. The mistake was a simple one: the accidental omission of five rows of data when calculating an average.

哈佛大学(Harvard University)一篇有关公共债务与增长的颇具影响力的论文中出现了一个惊人的错误,让人们对金融危机后推出的紧缩政策的基石产生了怀疑。这个错误很简单:在计算平均值时意外遗漏了5行数据。

Another nightmarish slip-up arose when Public Health England misplaced nearly 16,000 Covid-19 test results. That was because someone had used the wrong Excel file format, XLS, which only has about 64,000 rows, so some cases vanished off the bottom.

还有一个噩梦般的失误是英国公共卫生署(Public Health England)丢失了近1.6万份疫情检测结果。这是因为有人使用了错误的Excel文件格式XLS,这种格式只有大约6.4万行,所以一些检测结果从底部消失了。

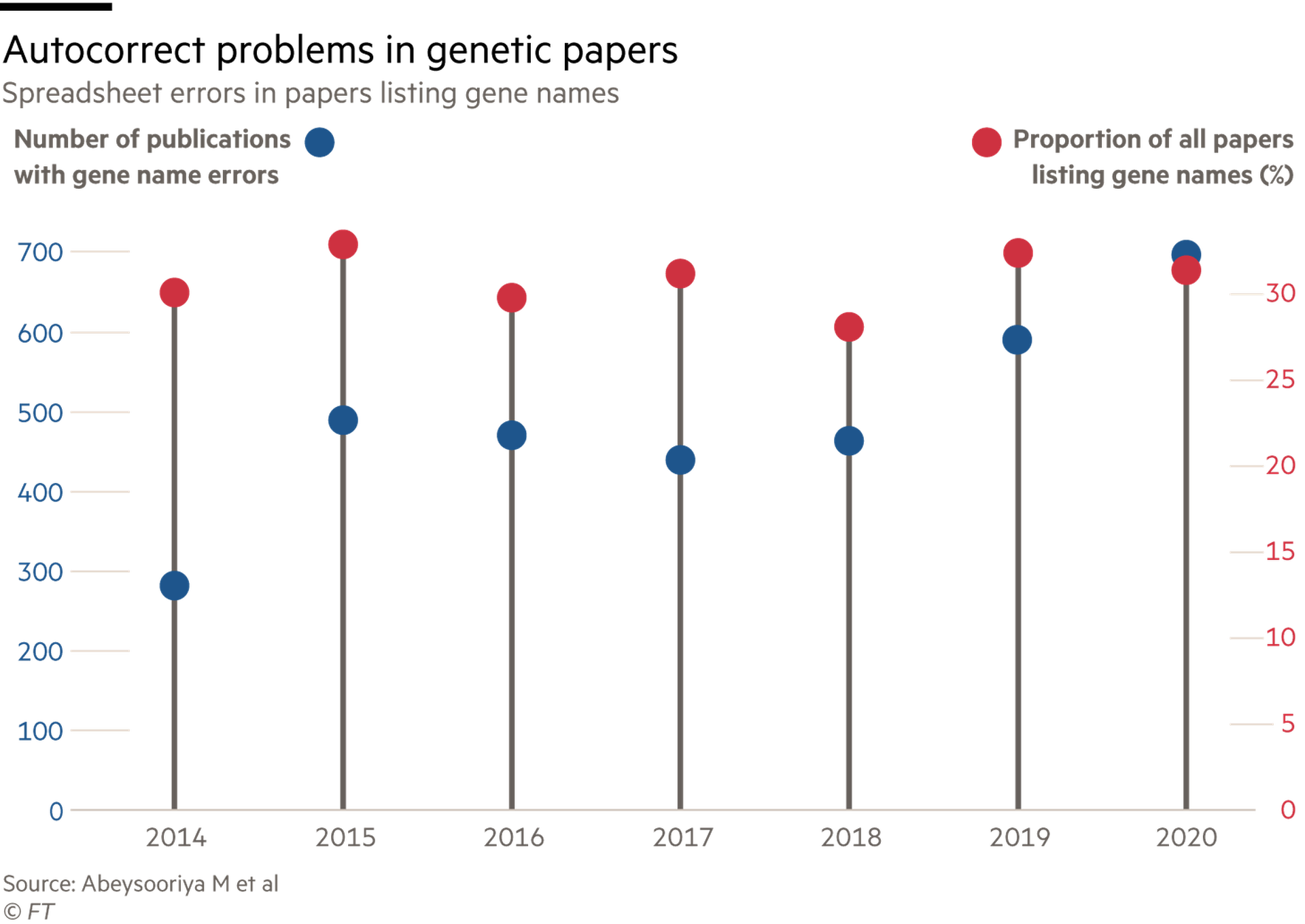

Sometimes, tools meant to help with accuracy add to the problem. Autocorrect errors are the bane of geneticists. Nearly a third of publications featuring gene names contain errors where the abbreviated form of a gene’s name is incorrectly recognised as a date. For example, SEPT4 (septin 4) is changed to 4-Sep.

有时,旨在帮助提高准确性的工具会使问题更加严重。自动校正错误让遗传学家感到头疼。近三分之一的以基因名命名的出版物含有错误,基因名的缩写形式被错误地识别为日期。例如,SEPT4 (septin 4)被改为4-Sep(9月4日)。

People do not take spreadsheets seriously enough, says Eusprig’s programme chair, Simon Thorne. Unlike software engineers who typically spend 40 per cent of their time testing their coding, many spreadsheet users hardly bother.

欧洲电子表格风险利益组织主席西蒙•索恩(Simon Thorne)表示,人们对电子表格的重视程度还不够。软件工程师通常会花40%的时间来测试他们的代码,与之不同的是,许多电子表格用户几乎不会为此费心。

Moreover, people are bad at picking up their own errors. Self-review catches, at most, about two-thirds of errors, according to research by Ray Panko of the University of Hawaii. Overconfidence is at the heart of the problem. People tend to be proudly aware of errors they fix. But they have no idea of how many remain.

此外,人们不善于发现自己的错误。根据夏威夷大学(University of Hawaii)的雷•潘科(Ray Panko)的研究,自我检查最多能发现三分之二的错误。过度自信是问题的核心。人们往往会自豪地意识到他们所修正的错误。但他们不知道还有多少错误没有被发现。