尊敬的用户您好,这是来自FT中文网的温馨提示:如您对更多FT中文网的内容感兴趣,请在苹果应用商店或谷歌应用市场搜索“FT中文网”,下载FT中文网的官方应用。

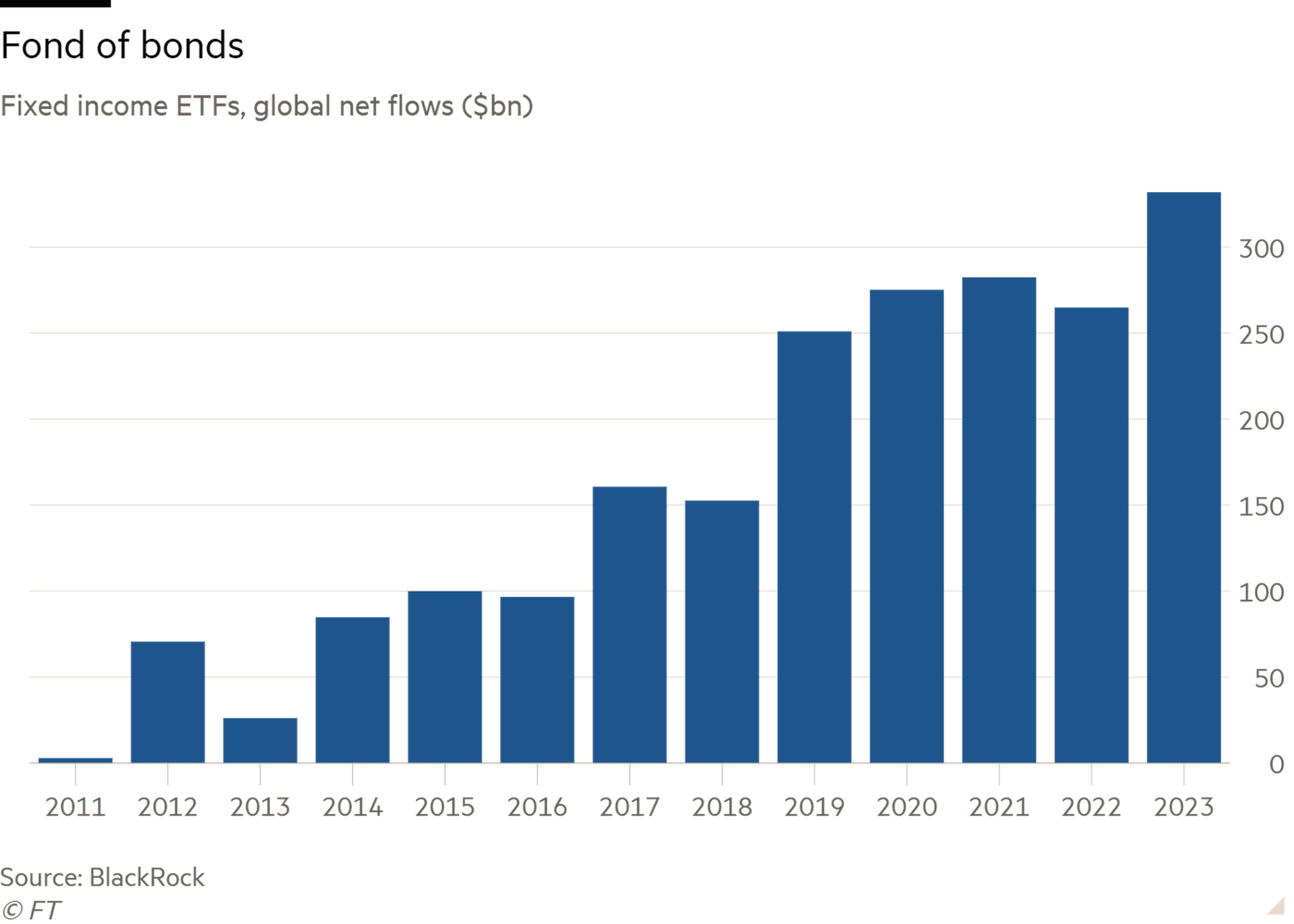

Exchange traded fund investors pumped record sums into fixed income and “quality” stocks last year as risk appetite jumped in the final months of 2023.

随着风险偏好在2023年最后几个月跃升,交易所交易基金投资者去年向固定收益和“优质”股票注入了创纪录的资金。

However inflation-linked bond funds and broad commodity ETFs experienced record outflows as sliding global inflation tempered investors’ desire to hedge against its corrosive effect on asset prices.

然而,与通胀挂钩的债券基金和大宗商品ETF却经历了创纪录的资金流出,原因是全球通胀下滑削弱了投资者对冲通胀对资产价格腐蚀性影响的愿望。

Overall, the global ETF industry recorded net inflows of $965bn last year, according to data from BlackRock, up from $867bn in 2022. This was the second-highest figure on record, behind 2021’s $1.3tn.

贝莱德的数据显示,去年全球ETF行业总体录得9650亿美元的净流入,高于2022年的8670亿美元。这是有史以来第二高的数字,仅次于2021年的1.3万亿美元。

“It’s interesting to see it compare to 2021, even though we had so many rate hikes,” said Karim Chedid, head of investment strategy for BlackRock’s iShares arm in the Emea region, referring to the fact that tighter monetary policy tends to weigh on equity and bond prices.

贝莱德旗下安硕(iShares)在欧洲、中东和非洲地区的投资策略主管卡里姆•切迪德(Karim Chedid)表示:“与2021年相比这很有趣,尽管我们有那么多次加息。”他指的是货币政策收紧往往会给股票和债券价格带来压力。

Unlike 2021 and 2022, when equity funds dominated, ETF flows were more balanced last year. Stock funds sucked in a net $640bn, below the $1tn of 2021, but fixed income ETFs vacuumed up a record $332bn, surpassing the previous zenith of $282bn in 2021.

与股票基金占主导地位的2021年和2022年不同,去年ETF的资金流动更为平衡。股票基金净吸纳6400亿美元,低于2021年的1万亿美元,但固定收益ETF吸纳了创纪录的3320亿美元,超过了2021年2820亿美元的上一个顶峰。

Fixed income’s record year was capped by a sharp pick-up in risk appetite in the final quarter. Flows into sovereign bond ETFs, which had dominated earlier in the year, fell to $31.9bn in Q4, their lowest figure since Q1 2022.

最后一个季度,风险偏好急剧上升,为固定收益创纪录的一年画上了句号。今年早些时候占主导地位的主权债券ETF流入量在第四季度降至319亿美元,为2022年第一季度以来的最低水平。

However riskier corporate bond flows spiked to $29.1bn in the quarter. The volte-face was particularly notable in high-yield bonds, which saw year-to-date net outflows of $8bn as of October 27, but then took in $17.1bn in the remainder of 2023.

然而,风险较高的公司债流动飙在本季度升至291亿美元。这种大转变在高收益债券领域尤为明显,截至10月27日,当年净流出80亿美元,但随后在2023年剩余时间里流入171亿美元。

Chedid said investors were “locking in higher yields” before they started to slide in line with inflation and interest rate expectations.

切迪表示,在收益率开始随着通胀和利率预期下滑之前,投资者“锁定了更高的收益率”。

Todd Rosenbluth, head of research at VettaFi, a consultancy, saw the scope for more buying to come.

咨询公司VettaFi的研究主管托德•罗森布鲁斯(Todd Rosenbluth)认为,未来还会有更多的买盘。

“We are still in the early stages of fixed income [ETF] adoption globally,” he said. “Investors embraced fixed income ETFs in a rising rate environment and returns are likely to be better in 2024 if, as expected, the US Federal Reserve begins and continues to cut interest rates.”

“我们仍处于全球采用固定收益ETF的早期阶段,”他表示。“投资者在利率上升的环境中接受了固定收益ETF,如果美联储像预期的那样开始并继续降息,2024年的回报率可能会更好。”

The “everything rally” in the fourth quarter also bolstered equity ETFs. Those focused on US equities enjoyed their highest inflows on record in the fourth quarter, $197bn, helped by December’s record monthly tally of $97.2bn. Higher-risk emerging market equity ETFs saw their third-best month ever, taking in $22.3bn, the BlackRock data show.

去年第四季度的“全线反弹”也提振了股票型ETF。在去年12月创纪录的972亿美元的月度流入的推动下,专注于美国股市的ETF在第四季度获得了创纪录的1970亿美元资金流入。贝莱德的数据显示,风险较高的新兴市场股票ETF出现了有史以来第三高的月度表现,共募集资金223亿美元。

Sector-wise, 2023 was all about technology ETFs, which garnered $52.2bn, a light year away from the second most popular sector, financials, with $3.8bn.

从板块来看,2023年科技股ETF大行其道,共吸金522亿美元,第二大热门板块金融类的38亿美元与之相比差距巨大。

In terms of investment “factors”, quality — stocks with a high return on equity, stable earnings growth and low leverage — ruled the roost, with a record $36bn of net buying.

在投资“要素”方面,优质股票——股本回报率高、盈利增长稳定、杠杆率低的股票——占据主导地位,净买入额达到创纪录的360亿美元。

As a result, the iShares MSCI USA Quality Factor ETF (QUAL) was in the top 10 of US-listed ETFs by flows last year, with $11.1bn, Rosenbluth said, as quality stocks “did well in an uncertain economic environment”. QUAL returned 30.9 per cent last year, beating the S&P 500 by 4.6 percentage points.

罗森布鲁斯表示,其结果是,iShares MSCI USA Quality Factor ETF (QUAL)去年以111亿美元的资金流跻身美国上市ETF的前十名,因为优质股票“在不确定的经济环境中表现良好”。QUAL去年的回报率为30.9%,比标准普尔500指数高出4.6个百分点。

Funds targeting cheaper “value” stocks amassed just $5.3bn, the lowest reading for four years, while minimum volatility ETFs bled $16.4bn.

瞄准价格较低的“价值型”股票的基金仅募集了53亿美元,为4年来的最低水平,而波动性最低的ETF则流失了164亿美元。

ETFs investing on the basis of environmental, social and governance concerns also drifted out of favour. Even in their European heartland, they only accounted for 29 per cent of ETF inflows last year, compared with 61 per cent in 2022, according to Invesco.

基于环境、社会和治理问题进行投资的ETF也逐渐失宠。根据景顺(Invesco)的数据,即便是在欧洲中心地带,去年它们也只占ETF流入量的29%,而2022年这一比例为61%。

Also in the doghouse were inflation-linked bond ETFs, which haemorrhaged a record $20.7bn, as waning inflation eroded their appeal.

与通胀挂钩的债券ETF也受到冷落,损失了创纪录的207亿美元,原因是通胀减弱削弱了它们的吸引力。

The iShares TIPS Bond ETF (TIP) alone shipped $4.5bn, Rosenbluth said, as investors “were less apt to protect against an inflationary environment in 2023”.

罗森布鲁斯表示,仅iShares TIPS Bond ETF (TIP)就流出了45亿美元,因为投资者“不太愿意防范2023年的通胀环境”。

Slowing inflation may also have been a factor in the continued travails of commodity exchange traded products, which lost $15.4bn, their third straight year of outflows. Gold funds accounted for the bulk of this, shipping $13.5bn, the second-worst tally ever, while broad commodity vehicles shed $3bn, an all-time high.

通胀放缓也可能是大宗商品交易所交易产品持续亏损的一个因素,它们损失了154亿美元,为连续第三年流出。其中,黄金基金占了大部分,流出135亿美元,为有史以来第二差,而广义大宗商品基金则流出30亿美元,创历史新高。

“Given gold’s positive performance, this trend of under-allocating could be considered a missed opportunity by ETF investors,” said Matthew Bartolini, head of SPDR Americas research at State Street Global Advisors.

道富环球投资管理SPDR美洲研究主管马修•巴托里尼说:“鉴于黄金的积极表现,这种低配趋势可能会被ETF投资者视为错失良机。”

Chedid compared gold to value stocks, in that both tended to draw money during inflationary periods, but was nevertheless surprised by the unpopularity of gold ETPs, given the price rose 13 per cent last year. “The correlation between the two has broken down,” he said.

切迪将黄金与价值型股票进行了比较,因为两者都倾向于在通胀时期吸引资金,但他还是对黄金ETF不受欢迎感到意外,因为金价去年上涨了13%。他说:“两者之间的相关性已经被打破了。”

Chedid saw reasons to believe the bullish environment could continue into 2024.

切迪有理由相信,看涨的环境可能会持续到2024年。

“The risk rally has further legs to go if you consider there is a lot of cash on the sidelines that can be deployed,” he said, with safety-first money market funds attracting nearly $2tn last year, pushing their assets to $8tn, while in Europe average cash allocations in wealth portfolios have risen from 3 per cent in 2021 to 8 per cent.

他表示:“如果你考虑到有大量可以配置的场外现金,那么风险上涨还有进一步的空间。”以安全为优先的货币市场基金去年吸引了近2万亿美元资金,使其资产规模增至8万亿美元,而在欧洲,财富投资组合中的平均现金配置比例已从2021年的3%升至8%。

Rosenbluth was also upbeat, but expected a stock rotation. “I do think we are going to see great demand and strong performance for value investing. [These stocks] tend to do better in a falling interest rate environment. Financials, consumer staples and energy are favoured in value strategies,” he said.

罗森布鲁斯也表示乐观,但预计会出现股票轮动。他说:“我确实认为我们将看到价值投资的巨大需求和强劲表现。[这些股票]在利率下降的环境中往往表现更好。在价值投资策略中,金融股、主要消费品和能源股受到青睐。”

However Chedid warned that BlackRock’s house view is that the six interest cuts priced in for the US this year are “excessive”.

然而,切迪警告称,贝莱德的观点是,市场对美国今年6次降息的预期是“过度的”。

“We are not in the camp that inflation will come down nicely. Labour supply is tight in the US,” he said.

他说:“我们并不认为通胀会很好地下降。美国的劳动力供应紧张。”

More broadly, “from a macro perspective it’s hard to argue that there won’t be any volatility this year,” which central banks may be unable to help out with, unlike in the days of quantitative easing.

更广泛地说,“从宏观角度来看,很难说今年不会有任何波动”,与量化宽松时期不同,央行可能无法帮助解决这些波动。

“That’s the headwind for the risk rally that we saw in Q4,” Chedid said.

“这是我们在第四季看到的风险反弹的逆风,” 切迪表示。

Bartolini shared these concerns. “US equity markets, the engine behind the surge in global stock returns, enter 2024 with stretched valuations,” he said. “And geopolitical risks are likely to intensify, given 76 countries will hold elections in 2024.”

巴托里尼也有同样的担忧。他表示:“作为全球股市回报飙升背后的引擎,美国股市在进入2024年时估值过高。考虑到2024年将有76个国家举行选举,地缘政治风险可能会加剧。”